Empower Your Employees with Financial Confidence

A Safer, Smarter Alternative to Traditional Retirement Plans

SECURE Act

TAX CREDITS FOR BUSINESS OWNERS

Take Advantage of up to $5,500 in startup credits and up to $1,000 in credits per employee by establishing a retirement plan.

Congress passed new rules in the SECURE Act that offer tax credits for small business owners.

Eligible employers are those with 100 or fewer employees who establish a new employer sponsored retirement plan.

Employers who have enrolled their employees in a state-sponsored retirement plans are not eligible for these tax credits.

$5,000 Credit for Plan Start-Up Costs

Open a new retirement plan for you and your employees and claim a tax credit for the ordinary and necessary expenses that you paid for opening and administering an employer plan This credit is available for the first three tax years of a plan.

Who is eligible?

Businesses with 100 or fewer employees

Employer plans that are eligible for the credit include SIMPLE IRAs, SEP IRAs and 401(k)s.

How much is the credit?

For eligible employers with 50 or less employees, the credit is equivalent to the lesser of 100% of the start-up costs or $5,000 annually.

For eligible employers with 51 to 100 employees, the credit is equivalent to the lesser of 50% of the start-up costs or $5,000 annually.

$1,000 Credit for Employer Contributions

Credit equivalent to employers' contribution on behalf of each eligible employee, up to $1,000 per employee. Eligible employees are those making $100,000 or less

Who is eligible?

Businesses with 100 or fewer employees

Employer plans that are eligible for the credit include SIMPLE IRAs, SEP IRAs and 401(k)s.

How much is the credit?

The calculation differs depending on whether the eligible employer sponsoring the plan has 50 or fewer employees or 51-100 employees. The credit for employers of 50 or fewer is calculated by multiplying the total dollar amount of contributions made on behalf of eligible employees by the respective percentage for each year. The same calculation is done for employers of 51 to 100 employees with a reduction factored in.

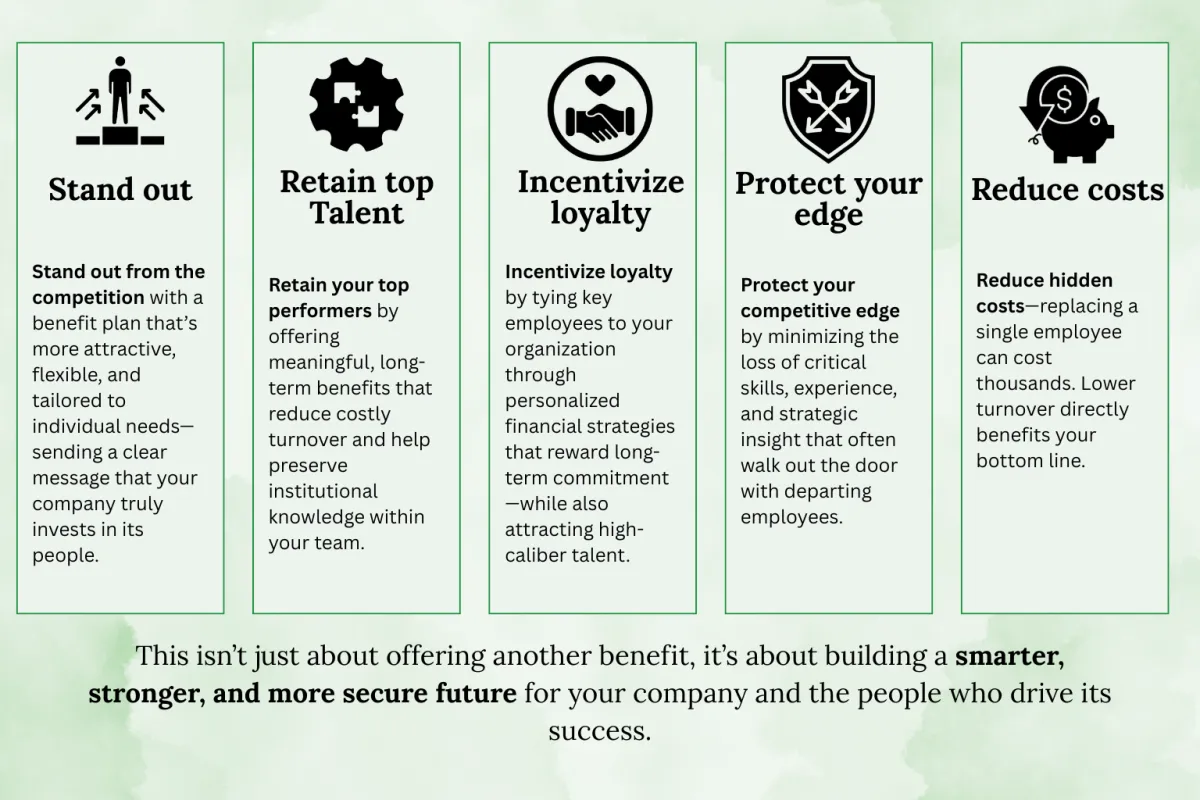

Have you considered offering your employees a Free Retirement Review? Many employees contribute to their pension or retirement plans without knowing how much they’ll receive when they retire.

A Retirement Review isn’t just a perk—it’s an investment in your team’s well-being, helping them plan effectively for the future while boosting their satisfaction and loyalty to your company.

What does a Retirement review consist of...

Clear, simple insights—helping employees make informed financial decisions.

No cost to you or your employees—we sponsor the entire service.

Greater employee confidence and retention—showing your commitment to their future.

Ready to Empower Your Workforce?

Schedule a Consultation Today

Your financial future starts with a single step. Whether you’re just getting started or need expert guidance to refine your retirement strategy, we’re here to help. Let’s create a plan tailored to your goals.

© Retire With Powers 2025 | Terms & Conditions | Privacy Policy